For this fifth study in our panorama series of Emerging Trends transforming cities and infrastructure, Leonard has joined forces with Good Tech Lab to present an overview of the available technology drivers in response to the climate and environment crisis.

However, we must not forget that while technology will play a fundamental role in the response to this global challenge, it will not be enough in itself. Ambitious public policies will also have to play a crucial role advocating carbon taxes and defining the path towards a fair transition, as well as encouraging a shift in uses towards carbon-free, low-resource consuming life styles.

Focusing on the strategic construction, energy and transport sectors, this panorama of CleanTech and ClimateTech does not claim to be exhaustive, but it does seek to be representative. Take the time to read it now and gear up for tomorrow.

Why this renewed interest?

After the euphoria of the 2000s followed by a long period of disinterest, CleanTech seems to be making a big return to centre stage. This second wave of environmental technology has even been gathering momentum in the past few months under a new buzzword in Silicon Valley: ClimateTech. This term refers to technology that is providing answers to the climate crisis: decarbonisation, negative emissions, adaptation, etc. It covers software, hardware and biotech, whereas CleanTech generally only refers to the last two.

The growing enthusiasm for CleanTech and ClimateTech this decade is attributable to several converging factors, as explained below.

- The worsening climate and ecology crisis, and the warnings issued by the scientific community. There has been a raft of study reports in the past 18 months showing that the impacts will come faster and be stronger than at first expected: three IPCC special reports (1.5°C, oceans and cryosphere, land use), the IPBES Global Assessment Report on Biodiversity and Ecosystem Services, the UNDP’s Global Resources Outlook on the unsustainable rate of natural resource consumption, and a major article on Climate Tipping Points in Nature.

- The reaction from society at large, especially under the influence of young people. In the street, of course, with the Fridays for Future and Extinction Rebellion marches. But also expressed at the ballot box, in spending choices and recruitment interviews: see the example of the student manifesto Pour un réveil écologique (For an ecological awakening).

- Governments are reacting by enshrining carbon neutral targets in law (France, UK, Denmark, Sweden, EU, New Zealand, etc.), or new regulations to promote the circular economy, biodiversity, etc. This is without taking into account the C40 cities.

- The gradual transformation of the private sector: like the giant BlackRock, institutional investors are becoming increasingly aware of climate risks (see the Task Force on Climate-related Financial Disclosures), as well as the opportunities around providing solutions for decarbonising the economy. Everyone agrees and low-carbon strategies are gradually taking shape: a growing number of major groups, including VINCI, are setting carbon neutral targets for 2050.

- Lastly, technological innovation provides new solutions to the climate and ecology challenges with digital technology reaching maturity and progress with DeepTech, energy, materials and AI.

The last point was the basis for observations in this fifth article in Leonard’s Emerging Trends series. As we said in the introduction, technology alone cannot solve everything, but it is a crucial source of drivers.

Energy: the dual need for large-scale rollout and technological breakthroughs

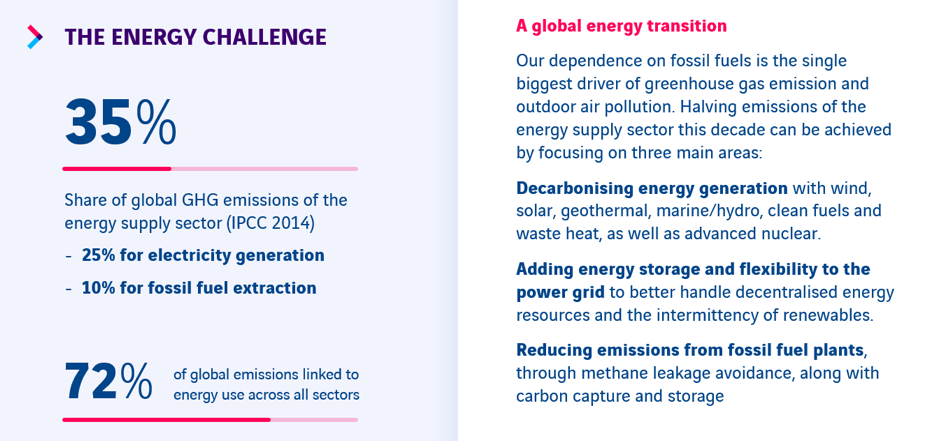

Our reliance on fossil fuels is still the single biggest driver of global warming. In particular, it contributes to air pollution and the deterioration of natural ecosystems. In its various forms, our energy consumption generates 72% of global greenhouse gas emissions, of which 25% is for electricity generation alone (IPCC AR5, 2014).

While renewables – excluding hydropower – still only account for a fraction of the total, their growth is reaching a tipping point. The cost of wind and, above all, solar power has dropped dramatically over the past decade. Capacity installation is growing exponentially, pointing to a faster rollout over the coming decade, especially in those regions where the electricity mix is still highly carbon-dependent.

As renewable sources reach maturity, a broad range of innovations could push back the decarbonisation boundaries even further:

- The increased efficiency of renewables, for example with materials that boost photovoltaic output (OxfordPV), float structures enabling offshore wind power to harness stronger winds, and progress in the field of marine energy (Eco Wave Power and Simec Atlantis)

- Extending the geographic limits of geothermal and hydropower, which are both renewable and non-intermittent

- The production of clean high-temperature heat for industry using a new generation of solar concentrators (Heliogen) together with the recovery of low-temperature heat that is generally lost

- The rise in sustainable fuels, providing solutions for sectors that are difficult to decarbonise, e.g. the cement, steel, aviation and marine industries. Hydrogen could play a major role in this portfolio of solutions, which should also include new-generation biomass or synthetic fuels

- New-generation nuclear power, in particular small reactors (NuScale, Seaborg), which are less costly, safer and produce less waste (some of these reactors could even recycle part of long-lived radioactive waste)

- Fusion energy might also only be 15 years away. In addition to the ITER project, around a dozen startups are developing alternative models of reactors (Commonwealth Fusion and Renaissance Fusion).

Production aside, energy storage is still a major challenge that needs to be solved to decarbonise the global economy. The issue here is to manage the intermittent nature of solar and wind power and to manage daily and seasonal variations in demand more efficiently. Pumped storage hydropower accounts for around 95% of global storage capacity, but its rollout is hampered by geographic limitations.

The cost of Li-ion batteries has fallen tenfold in 10 years. They are universally used in electric vehicles, but their economic and ecological cost makes them poorly suited to long-term storage or even stationary use.

Innovations in storage and network flexibility include:

- Long-term storage using thermal, chemical (power-to-x) and mechanical solutions. These very different solutions are at various stages of maturity. They are suitable for use in buildings and networks for storing energy for several days, weeks or even several months. Examples include Azelio, McPhy and Energy Vault. Flow (Form Energy) or zinc (e-Zn) batteries are two other forms of emerging technology for long-term energy storage

- New-generation batteries for electric vehicles and short-term storage can improve energy density, lifespan, safety and charge speed, and reduce the environmental impact from the extraction and end of life of metals. They can be divided into two categories: (i) improved Li-ion technology (new electrode materials and solid batteries), and (ii) alternative technology, such as sodium batteries (Tiamat)

- Super-capacitors have a virtually instantaneous charge and recharge time and are particularly well suited for braking energy recovery

- “Grid edge” technology improves grid balance and makes better use of distributed production and storage: virtual power plants aggregate the various sources of capacity, demand response systems, etc.

Construction: optimise infrastructure energy performance and intrinsic footprint

Buildings account for 10% of drinking water consumption and 18% of global GHG emissions through energy consumption. The technology available to improve energy efficiency includes:

- Smart building solutions, such as tools ranging from conventional management of lighting and services (air, water and heating) to more advanced functions. For example, Carbon Lighthouse installs 300 sensors in each building and applies machine learning to the data collected to identify a range of energy efficiency measures that deliver savings of between 20% and 30%

- Low-carbon boiler plants and air conditioning units that recover heat (air conditioner waste heat, latent heat in the ambient air and heating networks), geothermal storage (Accenta) and high-energy efficient heat pumps without HFCs (coolant gases that have a high global warming potential)

- Insulation materials: bio-sourced, phase change, aerogels, etc.

In addition to the impact of the use of buildings, there is also their “intrinsic footprint”. The construction industry is a leading resource consumer and waste producer. The production of cement and steel accounts for 4% and 5% respectively of greenhouse gases globally. Added to this, there is the impact attributable to construction site activity, before even taking into account the fact that 60% to 70% of 2050’s infrastructure hasn’t been built yet.

Materials with a low environmental footprint can provide a wealth of innovation possibilities for construction industry cleantech. Here are a few examples:

- Low-carbon cements, some examples of which are already available on the market: geopolymers or alternative cements in which the clinker is partially replaced with moulded blast-furnace slag (Ecocem, in partnership with VINCI). Emerging technology includes cements derived from captured CO2 (CarbiCrete) or using biotechnology. Depending on the process used, the carbon reduction in low-carbon cement is between 30% to over 100% (carbon sinks)

- Zero-carbon steel could become a reality with a carbon-free source of heat, such as hydrogen, or an electrochemical process like that developed by Boston Metal

- Circular materials: (i) the reuse of unused site materials through marketplaces (Backacia) or materials salvaged from deconstruction, using a Material Passport (Madaster) connected to BIM models. For non-reusable materials, (ii) recycling is improving as demonstrated by the 100% reclaimed asphalt pavement (RAP) used by Eurovia on France’s A10 motorway

- Cross-laminated timber is a durable and strong material for which demand is rising exponentially. Demand is also being driven by the growth in modular offsite manufacturing, for which this material is ideally suited. Some companies, like Katerra, offer a high-tech version of this process using digital manufacturing and automation tools

- Fuel cells can be used to replace diesel electric gensets with hydrogen (Powidian), for example to power construction barracks. Eventually, they could be used to supply electricity for heavy construction machinery. Electric versions of many types of light machinery already operate using batteries

- Low-carbon design software can generate simulations for buildings (Vizcab) or whole towns (Urban Footprint).

Air pollution abatement is another major issue for the building sector. Indoor air treatment using membrane, air exchanger and nano-particle systems aims to ensure the air complies with health requirements and user comfort needs.

Buildings can also contribute to abating ambient air pollution, for example with green roofs and façades. Micro-algae (Arborea, XTU Architects) are opening up promising avenues in this area. They have a pollution abatement and CO2 capture potential greater than the usual urban vegetation per unit of surface area and can produce a range of resources like protein and fuel.

Transport and its three main challenges: batteries, modal integration and long-haul

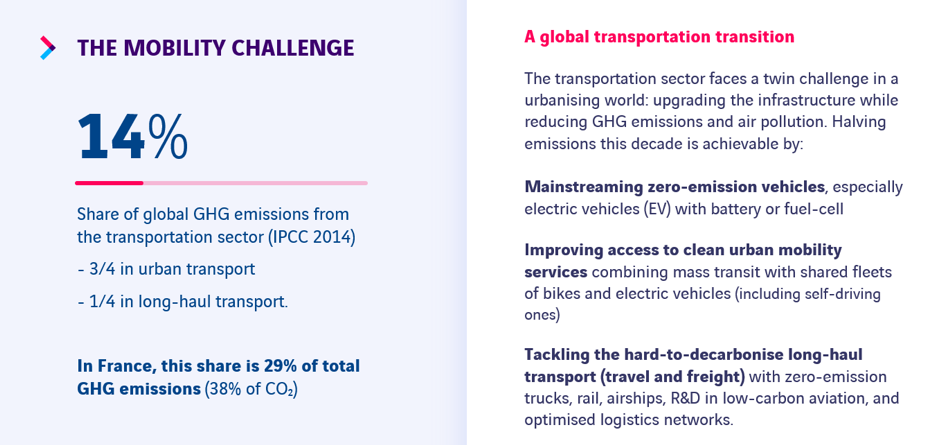

The challenge for the transport sector is to adapt infrastructure to a rapidly urbanising world while also drastically reducing GHG emissions (14% globally and 29% in France), and atmospheric pollution.

According to the IEA (whose estimates are often conservative), there may be 250 million electric vehicles on the road by 2030. While battery production is scaling up, along with charging infrastructure, EV penetration rates differ widely from one country to another: 50% of sales in Norway in 2019 compared with 2% in France.

The areas of innovation for zero-emission vehicles include:

- Battery-powered electric propulsion: (i) the new-generation batteries and supercapacitors mentioned above, and (ii) the extension of electric propulsion to vehicles other than cars and e-bikes, e.g. buses (BYD, Proterra), trucks (Xos Trucks), and short-haul aircraft (Heart Aerospace)

- Charging infrastructure developments: rapid chargers in self-service stations, vehicle-to-grid (V2G) and emerging solutions such as dynamic wireless charging

- The rollout of hydrogen for trucks and long-haul trips: trucks, trains, short-haul aircraft and container ships. These modes use either a fuel cell or autonomy extension (Symbio), or a hydrogen or hydrogen-diesel combustion engine (HyTech)

- R&D into other sustainable fuels for the long-haul sector: synthetic fuels (LanzaTech) and next-generation biofuels.

In large cities, mobility services are a necessity and many are opting for carbon-free transport. For municipalities, the creation of cycleways and walkways, self-service bike hire and electric buses are quick fixes adopted to mitigate air pollution and CO2 emissions, and provide feeders for metro and light rail networks. EV and e-bike fleets for use on demand are other types of service that are part of the carbon-free transport approach.

On the other hand, self-service e-scooter hire, while popular, is nonetheless controversial. The life-cycle analysis of scooters is not encouraging because of their short lifespan (between one and three months), and because they tend to replace green mobility and public transport rather than personal cars.

Several technological challenges have the potential to push back the boundaries of decarbonisation in the urban mobility sector:

- The shift of MaaS (Mobility as a Service) towards greater integration with public transport (Whim) and a focus on light and electric mobility, rather than the individual ride-hailing services that popularised the concept

- Self-driving, shared and electric vehicles could in theory reduce the number of cars tenfold in cities, but level five autonomy (self-driving) is still largely out of reach. The first examples of its use are concentrated in specific designated low-speed areas, such as campuses (EasyMile) and autonomous logistics (Einride)

- Simulation tools for travel routes are helping cities optimise their transport infrastructure (Replica, Entropy)

- Smart transport systems basing payment on infrastructure usage are banking on the signal price impact on users to curb the use of highly polluting and low-occupancy vehicles.

The role of negative emissions

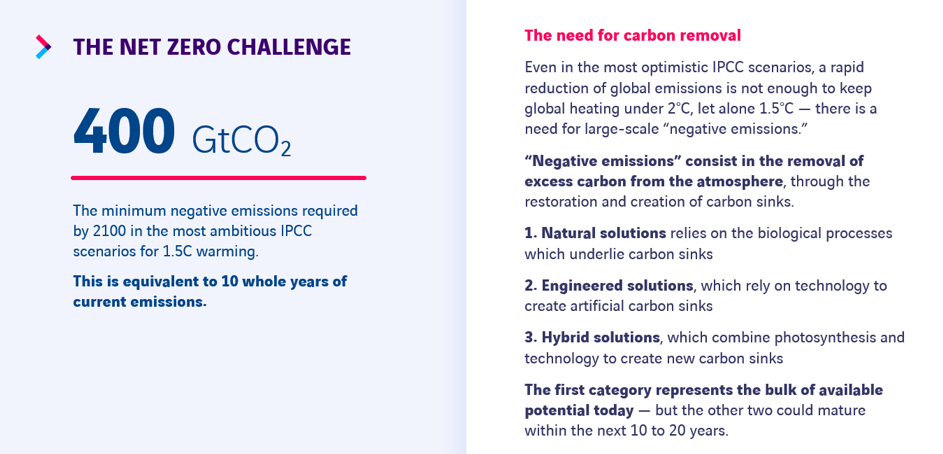

Rapid decarbonisation of the world’s economy is fundamental, but even in the IPCC’s most optimistic scenarios, it will not be enough to meet the 1.5 °C or even 2 °C target. The models scientists use to establish these various scenarios require “negative emissions” on a more or less large scale. This refers to “carbon removal”, which means the use of carbon sinks to remove some of the greenhouse gases already accumulated in the atmosphere.

- Natural solutions are based on biological processes, photosynthesis in particular, to allow soil and vegetation to sequester CO2. Technology can, however, assist carbon markets (Pachama, Nori) or speed up reforestation (Dendra Systems).

- Technological solutions aim to create artificial carbon sinks, such as direct capture in the air (Climeworks), enhanced weathering (accelerated version of the natural process of erosion and sedimentation), and conversion of captured carbon into new products. This last possibility includes construction materials (Made of Air), fuels and chemical products (Opus12), plastics and polymers (Newlight), proteins (Solar Foods) and nanomaterials (Carbon Upcycling Technologies); a fraction of these products could eventually have a negative carbon footprint.

- Hybrid solutions combining photosynthesis and technology to create new carbon sinks. Such is the case of “biochar”, a sort of charcoal used as a soil improver (Carbo Culture), and potential processes based on microalgae and phytoplankton. Bio-energy with carbon capture and storage (BECCS) is another avenue being explored and is often referred to in IPCC scenarios, but this method is highly controversial because of the environmental issues around biomass monoculture.

While natural solutions are the only ones that have so far reached maturity for large-scale CO2 capture, the other two categories could reach maturity in the next two decades to form a diversified portfolio of solutions.

Conclusion

While this new wave of CleanTech and ClimateTech allows us a sense of measured optimism for the present decade, it should not lull us into a false sense of security. First, technology will be needed but it will not be enough to solve the climate and ecology crisis: political and behavioural drivers will play an equally decisive role.

Second, the predominance of global warming in people’s minds should not overshadow the other global commons: biodiversity, land use, oceans and water resources. It is crucial to encourage life cycle analysis and other rigorous impact management methods. The notion of carbon neutrality, for example, suffers from the lack of a standard that the Net Zero Initiative is seeking to correct.

Third and last, CleanTech already had its time in the spotlight in the 2000s before a disillusioned market turned its attention to other investments. The several spectacular failures in biofuel and thin-film solar technology aside, the venture capital model has often been seen as being ill adapted to the sector’s companies (in particular in an MIT report). Compared to software and internet companies, CleanTech companies need longer development times and include high risks, especially technological and regulatory.

Even so, in 2020, this last statement needs to be qualified in light of the growing maturity of DeepTech funds (often inspired by peers in the biotech sector), the convergence between software and infrastructure, and the emergence of alternative fund structures better suited to heavy-asset industries or long-term investments. Also, major corporations and public and philanthropic stakeholders are ideally placed for this type of strategic investment. That is a source for optimism when penning the next chapter over the coming decade.

Article written by Benjamin Tincq, co-founder and CEO of Good Tech Lab